Buckingham County supervisors expand some tax benefits

Published 2:36 pm Friday, September 15, 2023

|

Getting your Trinity Audio player ready...

|

DILLWYN – There’s good news for senior citizens in Buckingham County. More will now be able to benefit from the county’s tax rules. During their meeting on Monday, Sept. 11, Buckingham supervisors expanded the current tax benefits a bit.

This ordinance lays out the qualifications to provide a stabilization of real estate tax for the elderly and disabled in Buckingham if they meet the requirements. This means that those eligible will be taxed according to the real estate tax rate when they apply until the property changes ownership.

On Monday, supervisors adjusted the income restrictions to allow for more residents to receive this benefit. The vote changed the income restriction from $35,000 to $40,000 and changed the net combined worth from $80,000 to $100,000.

“Both of these proposed changes were done because this ordinance was adopted maybe 10 or 15 years ago so things have changed so much that we want to give more people a chance to qualify and take advantage of this program,” said Karl Carter, county administrator.

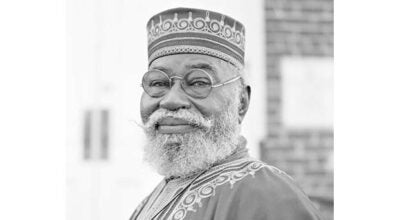

During the hearing, Gordon Winn echoed Carter’s remarks that the maximum hasn’t changed despite changes in the cost of living during that time, including inflation. He also mentioned that many who need help have to get a part-time job or have a fixed income from social security which causes them to go above the threshold and “back in the hole” of needing help. Raising the income restriction will allow for more elderly and disabled citizens to get the help they need.

“This program sends a clear message to the elderly and disabled people of Buckingham County that this county administration does care about them and their situation,” said Winn. “Not only could it prevent some current qualifiers from losing it but will allow others who are struggling to make ends meet and receive this benefit.”

The vote was unanimous, with Supervisor Dennis Davis absent. This will become effective on Monday, Jan. 1, 2024.

How do these tax benefits work?

To take advantage of this ordinance, there are a few qualifications residents need to meet before taking part. Residents must own the real estate and occupy the dwelling on the property that this tax stabilization is sought for. The applicant must also be at least 65 years old or permanently and totally disabled. Starting the first of next year, the total combined income received from all sources during the preceding calendar year can’t exceed $40,000 and the net combined financial worth cannot be over $100,000. They also must be a resident of Buckingham for five years before applying.

To apply, residents can file with the Commissioner of Revenue on forms supplied by the county, an affidavit or a statement containing the names of those on the property’s total combined net worth, including equitable interests and the combined income from all owners of the real estate property.