Cumberland supervisors approve changes, sign off on budget

Published 7:08 am Tuesday, April 30, 2024

|

Getting your Trinity Audio player ready...

|

Cumberland County supervisors did two things during their special meeting on Tuesday, April 23. They approved a final budget and set the tax rates for the upcoming fiscal year. By a unanimous vote, with Eurika Tyree absent, supervisors approved a $41.434 million budget. That’s an increase of $66,214 over the current year.

So the overall budget increased, what about the real estate tax rate? The rate itself went down, but residents will still see a higher tax bill. Why? You can thank the real estate reassessment that took place over this past year. The estimated value of homes throughout the county spiked.

“(The) total assessed value of real property, excluding additional assessments due to new construction or improvements to property, exceeds last year’s total assessed value of real property by 27.78%,” said Cumberland Administrator Derek Stamey.

The real estate values are higher, so to get the same amount of revenue in as last year, the county needed to drop the tax rate down to 59 cents per $100 of assessed value. They opted not to do that, as there was a need for more revenue, in order to balance higher bills. As many other counties have experienced, the cost of doing business, that is the cost of everything from a new ambulance to needed sewer line repairs, has gone up. As a result, supervisors have been working through weeks of budget workshops to find ways not just to balance the budget, but try and absorb some of the pain the next tax bills will bring.

They couldn’t cut enough to get it down to that 59 cent tax rate, however. Instead, supervisors unanimously voted to adopt a 60 cent per $100 of assessed value rate for real estate taxes.

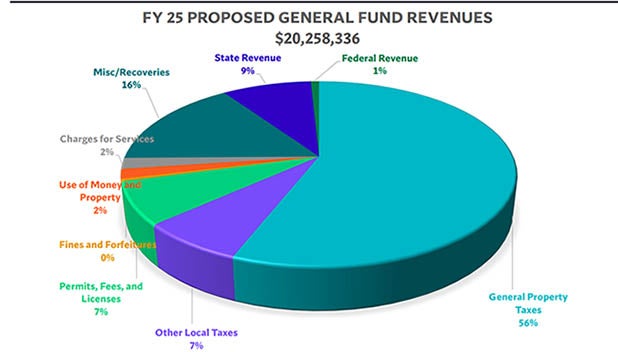

A look at where the county gets its funding for the newly adopted budget.

Cumberland supervisors advised of problems

The problem, Stamey explained to the board in his budget presentation, is that the county relies too much on one revenue stream.

“The county is essentially a one-legged stool,” Stamey told the board. “That’s the best way I can explain.”

He was referring to the fact that 56% of general fund revenue this year will come from property taxes, including real estate. Recoveries make up another 16% and the third highest money source is state revenue at 9%. Combined, those three sources make up 81% of the county’s general fund revenue.

“We are heavily dependent on general property taxes which is why we need to continue to fight to find ways to acquire revenue streams, to take that burden off taxpayers,” Stamey said.

The one potential positive for the upcoming fiscal year comes from solar. The county expects to bring in an estimated $1.363 million in fees and taxes from the handful of solar projects that have been approved and are moving forward.

So you know where it comes from, but how’s it being spent? More than half of the general fund dollars will go to Cumberland schools. An estimated 54% of this upcoming year’s general fund will go for school operations.

“That’s fairly normal,” Stamey said, pointing out that counties across the region range from 50-55% when it comes to what percentage of their general fund budget go to schools. For the upcoming year’s budget, Cumberland will meet the school district’s needs, increasing their allotment by $223,093.

The problem, he said, comes from another source. A total of 7% of the overall general fund budget will be used this year to pay on debt service, as the county continues to pay for previous renovation and construction projects. That includes work on the elementary, middle and high schools.

Beyond the school district, the highest percentage of the general fund budget goes to public safety at 12%. The sheriff’s office got a slight bump, going from $1.25 million for salaries last year to $1.263 million. That’s to help fund a 3% salary increase.

Cumberland Fire and EMS also saw a $352,044 increase, with that mainly going to cover increased fuel costs and a slight raise for county employees.

Looking ahead

The county also had to make some cuts, in order to keep the tax rate from going higher. There were three vacancies in Public Works left unfilled and one part-time position in Planning and Zoning left as well.

As far as future projects, Cumberland supervisors cited the New Business Task Force, created to recruit companies to the county. County staff also plan to update solar revenue projections and revisit leases and agreements at current county-owned facilities. Finally, Cumberland staff will look at possibly outsourcing some of the operations currently done by county staff, Stamey said.

Cumberland supervisors said they acknowledged the challenges and want to do their part, when it comes to finding new revenue streams.

“I think the first thing we should be doing as a board is be creative how we spend money,” Chairman of the Board John Newman said.

His comments were echoed by fellow supervisor Robert Saunders Jr., who also thanked Superintendent Chip Jones and the rest of the school staff for working with Cumberland on this budget.

“This ain’t the first time Cumberland has been through a rough patch, so we can pull it together,” Saunders said.